Washington: U.S. President Donald Trump’s new retaliatory tariff policy has sent shockwaves through the global economy. Under this aggressive policy, steep tariffs have been imposed on foreign imports, triggering a significant downturn in the U.S. stock market. On Thursday, Wall Street witnessed a dramatic sell-off, wiping out $2.4 trillion in value from S&P 500 companies in a single day—marking the biggest one-day decline since March 2020. Experts warn that this strategy could push not only the U.S. economy but the entire global trade system toward a recession.

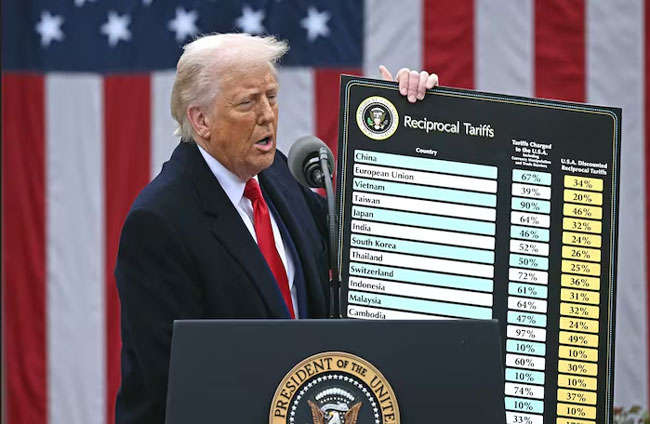

Trump announced the policy during a ceremony in the White House Rose Garden on Wednesday. The new measures impose a baseline tariff of 10% on all imports, with significantly higher rates for certain countries: 34% on Chinese goods, 20% on the European Union, 46% on Vietnam, 27% on India, and 24% on Japan. Trump stated that the move aims to boost domestic manufacturing and strengthen strategically important industries. However, economists and investors have labeled it a risky gamble.

Following the announcement, U.S. markets plunged on Thursday. The Nasdaq Composite dropped 5.97%, marking its worst daily performance since 2020, while the Dow Jones Industrial Average and S&P 500 also hit their lowest levels since June 2020. The sell-off wiped out more than $2 trillion in market value, sparking widespread investor panic.

Sectors including banking, retail, apparel, aviation, and technology experienced sharp declines. Experts suggest that if tariffs lead to higher prices for goods and services, consumer spending—one of the pillars of the U.S. economy—could shrink, impacting sales and production. Several economists called Trump’s tariff decision “worse than expected,” prompting a rapid sell-off of shares in companies most exposed to the new duties.

Analysts warn that the tariffs could escalate into a full-blown global trade war, potentially triggering recessions in both the U.S. and other nations. Olu Sonola, head of U.S. economic research at Fitch Ratings, said, “This policy is not just a game-changer for the U.S. economy, but for the global economy. If the tariffs remain in place for an extended period, multiple countries could slide into recession.”

Rising import costs will likely raise prices for U.S. consumers, directly affecting their wallets. Consumer spending makes up nearly 70% of the U.S. economy. If people cut back on purchases due to inflation, businesses may scale down production, potentially slowing economic growth or even initiating a contraction. JPMorgan analysts warned that if the tariffs are not rolled back, both the U.S. and global economies could enter recession by 2025.

The impact of Trump’s tariffs isn’t confined to the U.S. The European Union, China, and other affected countries have threatened retaliation. European Commission President Ursula von der Leyen called the tariffs a “major blow” to the global economy and stated the 27-member bloc is prepared to respond. China, for its part, announced new counter-tariffs on U.S. agricultural products.

Some analysts fear this could spiral into what they’re calling a “spiral of doom,” potentially leading to a global recession. IMF Managing Director Kristalina Georgieva said that while the world is not currently in a recession, Trump’s actions could prompt a slight downward revision to the 2025 global growth forecast of 3.3%.

Amid market uncertainty, investors are retreating from riskier assets and flocking to safer investments. Demand for U.S. Treasury bonds surged on Thursday, pushing the yield on the 10-year note down to 4.05%, its lowest since October. Gold prices also hit record highs, climbing above $3,160 per ounce before stabilizing at $3,106.99.

Industries heavily reliant on global supply chains are being hit the hardest. Tech companies, which import most of their components from abroad, and the auto sector, which depends on Canadian and Mexican imports, are facing mounting pressure. Delta Airlines slashed its Q1 earnings forecast by half, causing its shares to plummet 14%. Retail giants like Nike and Ralph Lauren also took a hit due to high tariffs on goods from manufacturing hubs like Vietnam, Indonesia, and China.

However, not all sectors are suffering. Utilities showed some resilience, with a 1% gain on the day. Domestic automobile manufacturers like Ford and GM remained relatively unaffected, as most of their steel and aluminum are sourced domestically.

Trump, however, appeared unfazed by the market crash. “I think it’s going very well,” he said, predicting that the market would “rebound sharply.” But many investors and analysts believe this uncertainty will persist until the tariff policy becomes clearer and responses from other nations unfold.

In conclusion, Trump’s tariff move has pushed the global trade system into uncharted waters. While it might benefit domestic manufacturing in the short term, it also carries the risk of triggering a recession. Investors, businesses, and consumers alike are now watching closely to see how the situation evolves. Upcoming decisions by the U.S. Federal Reserve and retaliatory moves by other nations will determine the trajectory of this economic crisis. For now, one thing is clear: Trump’s policy is a high-stakes gamble with potentially long-lasting consequences.